Market Activity

California single-family home and condominium sales fell 16.8 percent

in September from August, but were nearly unchanged from a year ago. An

18.7 percent monthly drop in distressed property sales drove the

decline in September sales.

Bear in mind that September’s double-digit drop in sales is not

unusual for this time of year because sales volume typically declines in

fall and winter.

To get a clearer picture of current real estate sales trends and to

eliminate seasonal factors, we compare September 2013 property sales to

September sales in prior years. Last month’s sales were slightly lower

than sales in September 2012 and the lowest since September 2007.

Dividing sales into their distressed and non-distressed components,

distressed property sales fell 47.7 percent in the past 12 months while

non-distressed sales jumped 40.2 percent. Though distressed property

sales declined in September, they still accounted for 24.2 percent of

total sales, which is historically very high. In six of California’s

largest counties — Stanislaus, Solano, San Joaquin, San Bernardino, Kern

and Fresno — distressed property sales represented 32 to 35 percent of

total sales.

Dividing distressed property sales into short sales and bank REO

resales can provide a better understanding of underlying trends. Short

sales fell 18.3 percent in September and are down 46.3 from a year ago.

Also, bank REO resales are down 19.5 percent for the month and down

50.2 percent year-over-year.

Homeowner Equity

The steady rise in home prices since January 2012 has allowed

thousands of California homeowners to shift from being underwater to

having positive equity so they can refinance or sell their homes. Since

July, the number of homeowners with more than 10 percent equity in their

homes has increased by 10.4 percent, or 465,000. The number of

homeowners who are moderately to severely underwater has fallen by 37.1

percent or 682,000.

Despite the improvement, large numbers of underwater homeowners

remain a drag on the California real estate market. In September, nearly

one in four, or 1.5 million (22 percent) of California’s 6.8 million

homeowners were underwater while more than 420,000 (6 percent) were

barely above water (less than 10 percent equity in their homes). Since

closing costs are 6 to 10 percent of a home’s sale price, these

homeowners are effectively underwater. Added together, 28 percent of

homeowners (nearly 2.0 million) are underwater or barely above water,

which effectively shuts them out of the California real estate market.

Several of the largest counties in California continue to struggle

with much higher levels of negative equity. In Fresno, Merced, Solano,

San Joaquin, and San Bernardino counties, 27 to 34 percent of

homeowners, or one in three, are moderately to severely underwater.

Median Prices

The median sale price of a California home fell $5,000, or 1.4

percent, to $355,000 in September from $360,000 in August, the second

consecutive monthly decline. Year-over-year median prices increased

24.6 percent from $285,000 to $355,000.

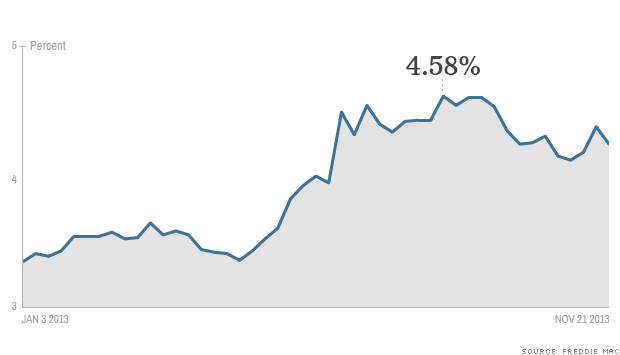

Rapid monthly home price increases that typified the California real

estate market earlier this year appear to have slowed ore reversed

course in direct response to a 100-basis-point increase in mortgage

interest rates in June. Despite the slowdown in price appreciation

statewide, homes in Orange, Placer and Riverside counties still

experienced solid price appreciation in distressed and non-distressed

properties.

Rapid changes in the mix of distressed and non-distressed property

sales from 2012 to 2013 continue to influence the year-over-year change

in median prices. In September 2012, distressed property sales accounted

for 46.1 percent of sales. By September 2013, distressed property sales

had fallen to 24.2 percent of sales.

The following graph highlights median sales price trends from January

2002 to September 2013. Aggregate single-family home median sales

prices are shown in blue, and distressed and non-distressed median

prices are shown in red and green, respectively.

Cash Sales

In September 2013, cash sales represented 24.5 percent of total

sales, up 0.1 percentage points from 24.4 percent in August. Taking a

longer-term view, cash sales as a percent of sales oscillated between 28

percent and 31 percent from January 2012 through January 2013. They

peaked at 33.0 percent in February 2013 and have been below 25 percent

since August 2013. From a historic perspective, cash sales remain high

and are an important part of the real estate marketplace even though

they are now trending lower.

Flipping

Mirroring the normal seasonal slowdown, September 2013 flipping

(reselling a property within six months) fell 10.3 percent from August

but was up 4.8 percent from a year ago. Flips represented 4.7 percent

of total sales in September, up from 4.3 percent in August.

Taking a longer-term view, in 2011, as housing prices trended

sideways, flipping was basically flat, ranging from 2.5 percent of sales

in January to 2.7 percent of sales in December 2011. In 2012, flipping

as a percent of sales began to increase, rising from 2.9 percent of

sales in January 2012 and peaking in February 2013 at 5.5 percent.

Flipping retreated from February 2013 to June 2013, reaching an interim

bottom of 4.1 percent of sales. In the past three months, flipping has

edged higher because investment returns remain attractive.

In September, flipping as a percent of sales was highest in San Diego, Sacramento, Fresno and San Joaquin counties.

Investor (LLC and LP) Purchases

September 2013 investor purchases fell 18.0 percent from August.

Investor purchases are defined as a market or third party purchase at a

trustee sale by a limited liability corporation (LLC) or a limited

partnership (LP). In general, investor purchases have been trending

lower since peaking in October 2012 and are now 54.9 percent below that

peak. This is being driven primarily by the increase in purchase

prices. As prices increase, the potential return on investment (ROI)

for holding properties as rentals decrease, making it less attractive to

investors.

Foreclosures

September foreclosure sales

fell to their lowest level in seven years. California Notices of

Default fell 21.6 percent in September, the largest one-month decline

since March, and are down 56.1 percent for the year. Meanwhile, Notices

of Trustee Sale dropped 20.3 percent for the month and fell 61.5 percent

for the year. Foreclosure sales gained 1.8 percent for the month but

remain near their lowest levels since January 2007.

Madeline’s Take – Director of Economic Research, PropertyRadaR

For the second consecutive month, September sales

and

median prices fell simultaneously as the California real estate market

responded to the increase in mortgage interest rates, the decline in

cash sales and investor purchases, and an increase in unsold inventory.

As we predicted last month, Fed Chairman Ben Bernanke chose to keep

QE3 bond purchases at current levels to support the housing market. The

violent mid-June bond market reaction to Bernanke’s mere mention of

slowing QE3 bond purchases caught the Federal Reserve by surprise. The

100-basis-point jump in 30-year mortgage interest rates was enough to

send the Federal Reserve scampering for cover and postpone any further

talk of tapering to 2014. As a result, mortgage interest rate

volatility declined and fear-based real estate buying and selling

retreated into the background. While sales have retreated slightly in

response to higher borrowing costs, lower prices and increased inventory

is welcome news for homebuyers who have been shut out of the market.

Sean’s Take – Founder/CEO, PropertyRadar

I recently testified at a State Senate hearing on the Home Owner Bill

of Rights. Many are excited about the large reduction in foreclosures,

and point to it as a sign that the housing market has recovered. As I

reviewed foreclosure and housing trends in preparation for my testimony

one thing stood out to me above all others. Despite all of the

foreclosures to date (over 1 million in CA alone), short sales, loan

mods, and refinances, we still have 1.5 Million homeowners who remain

underwater. That’s only a bit more than 50 percent lower than where we

started over five years ago. I’m glad the market feels better, but real

recovery should be far farther along, and still has a long way to go.

Real Property Report Methodology

California real estate data presented by PropertyRadar, including

analysis, charts and graphs, is based upon public county records and

daily trustee sale (foreclosure auction) results. Items are reported as

of the date the event occurred or was recorded with the California

county. If a county has not reported complete data by the publication

date, we may estimate the missing data, though only if the missing data

is believed to be 10 percent or less of all reported data.

Source –

Property Radar

Looking

back on the index, the biggest home price jumps were in 2004 and 2005,

when values were up as high as 16 percent annually. Those prices were

fueled by cheap and easy credit,

which certainly does not exist today. They were also fueled by

speculators who bought and flipped homes at a fast clip, putting no skin

of their own in the game.

Looking

back on the index, the biggest home price jumps were in 2004 and 2005,

when values were up as high as 16 percent annually. Those prices were

fueled by cheap and easy credit,

which certainly does not exist today. They were also fueled by

speculators who bought and flipped homes at a fast clip, putting no skin

of their own in the game.